Latest Development: Trump Raises Tariff to 125%, Announces 90-Day Pause at 10%

In a surprise move shaking global markets and intensifying uncertainty for American industries, former President Donald Trump has announced an increase in tariffs on Chinese imports from 104% to 125%, effective immediately. In a statement posted online, Trump justified the increase by citing China’s alleged disrespect for global markets, stating:

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately…”

However, he also introduced a temporary 90-day pause, during which a reciprocal tariff rate of 10% will apply:

“I have authorized a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

However countries like China are still facing a 125% increase and the 90 day pause is only for countries who have not given retaliatory tarrifs. The announcement has sparked a wave of analysis from trade experts, business leaders, and hospitality stakeholders. While the 125% rate signals a more aggressive trade stance, the temporary 10% tariff window offers a brief moment of relief for companies scrambling to adjust sourcing and procurement plans.

Shockwaves Through Hotel Operations (Renovations & Furnishings)

Hotels depend heavily on imported materials for construction, renovations, and day-to-day operations. A 125% tariff on Chinese goods stands to skyrocket the cost of furniture, fixtures, equipment (FF&E), and renovation supplies. Critical items like steel and aluminum (used in construction), lighting and plumbing fixtures, and guestroom furniture will all become far more expensive if sourced from China. Even hotels sourcing domestically manufactured products aren’t immune, because roughly half of all U.S. imports are inputs into domestic manufacturing – meaning American-made furnishings also incorporate foreign parts that now cost more. In short, renovation budgets and capital projects are being thrown into disarray.

Renovations and New Builds Delayed: Many hotel owners are expected to postpone or scale back planned renovations as material costs soar. Industry analysts note that higher prices for construction inputs (from Chinese-made carpet and tiles to Canadian lumber and Mexican cement) will “throw a wrench into the new-build pipeline,” putting downward pressure on the number of hotels breaking ground or getting renovated man Freitag, director at CoStar’s hospitality analytics, points out that “all that concrete coming from Mexico and all that lumber from Canada will now be more expensive,” which inevitably slows development Major U.S. hotel brands like Marriott, Hilton, and Hyatt typically count on new construction for ~70% of their annual growth, so a tariff-induced construction slowdown could significantly curb expansion. Projects already in progress may be completed, but analysts expect delays in openings and fewer new project signings as costs make many developments financially unfeasible.

Higher FF&E Costs and Quality Trade-offs: Ongoing operations will feel the strain as well. Hotels regularly replace and upgrade FF&E items – from lobby decor to in-room televisions – and much of this inventory has traditionally been sourced from Chinese suppliers due to cost-effectiveness. Now, with over 100% duties, a hotel that budgeted $1,000 for a new imported armchair might suddenly pay over $2,000 for the same chair (or seek a non-Chinese alternative). Procurement experts warn that hotels will “struggle to maintain high-quality interior designs without raising costs” under these tariffs. In other words, properties may face a tough choice: either pay exorbitant prices to stick with high-quality furnishings or downgrade to cheaper products from elsewhere. Some luxury hotels, for example, might delay replacing decor or settle for less opulent materials, while a budget hotel could opt to forgo non-essential upgrades entirely until costs stabilize.

Operational Equipment Challenges: Beyond construction materials, countless operational items are affected. Hotel facilities equipment – kitchen appliances, HVAC systems, elevators – often include Chinese-made components or electronics. A 125% import tax on, say, a Chinese-made commercial laundry machine or an elevator control unit could blow up maintenance budgets for large resorts. Even simpler items like vacuum cleaners or lawn equipment for hotel grounds will effectively double in cost if sourced from China. “Fifteen to 20 years ago, roughly 50% of what goes into a hotel room came from China… now it’s about 15%,” says Alan Benjamin, a hospitality procurement CEO, noting the industry had reduced direct Chinese sourcing over the past decade. But that remaining 15% comprises many specialized and cost-efficient items that hotels still rely on, and replacing those at double price will squeeze operating margins.

Many hotel furnishings and case goods have been manufactured in China at low cost; a 125% tariff makes these imports vastly more expensive. Hotels must now weigh paying the higher cost, finding alternate suppliers, or deferring upgrades – all difficult choices with operational implications. In some cases, Chinese vendors might attempt to absorb a portion of the tariff or reroute production through other countries, but with such a steep rate, significant cost increases are unavoidable. Luxury brands that insist on top-quality furnishings may have to pay more to maintain standards, while economy hotels might simply keep older furniture in service longer rather than buy pricy replacements.

Supply Chain Disruptions for Key Hotel Inputs

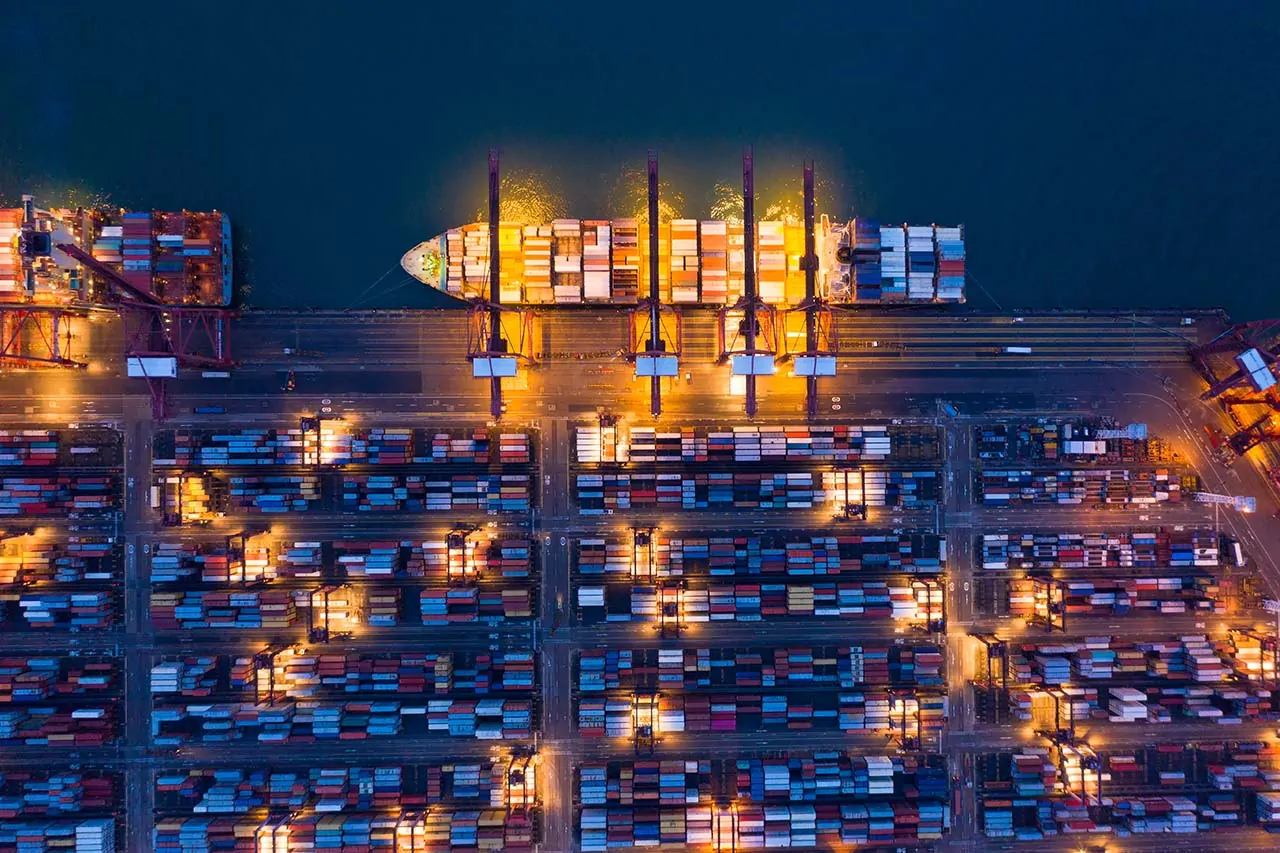

The tariff is triggering a supply chain shock across the hospitality sector. U.S. hotels source a vast array of goods from China – furniture, electronics, linens, lighting, and more – meaning the new import tax touches virtually every supplier relationship. Hoteliers and their procurement teams are scrambling to adjust orders and find workarounds as the flow of affordable goods from China is suddenly constricted.

The U.S. imported $438.9 billion in goods from China in 2024; a 125% tariff on these goods could add an estimated $418 billion in extra costs to American consumers if fully passed through. Hospitality supply chains – from hotel furniture warehouses to kitchen pantries – are heavily dependent on these imports. China accounts for about one-third of all textile products imported to the U.S., and is a “primary provider” of items like bedding and lamps. In practical terms, this means the cost of essentials such as hotel bed sheets, towels, curtains, mattresses, light fixtures and decor items is set to jump sharply. Even mid-range hotels that buy linens from a U.S. distributor will feel the pinch if that distributor’s cotton sheets were milled in China or if the lamps include Chinese-made parts.

Linens, Textiles & Guest Amenities: Most U.S. hotels rely on overseas mills (China, India, Pakistan, etc.) for their linens and textiles. With China supplying a significant share, the tariff impacts basics like bedding, towels, uniforms, and upholstered fabrics. Industry reports note nearly all hotel textiles are imported, and a large portion come from China. For example, the soft polyester fill in pillows and duvets, or synthetic drapery fabrics, often originate in China – these could face effective tariffs of 100%+, drastically increasing their price. A hotel that used to purchase bulk polyester linens from China at $10 per unit might now pay $20+ for the same unit (or try sourcing from elsewhere). Similarly, guest amenities and consumables are affected: many boutique hotels import specialty soaps, lotions, or teas (often sourced from Chinese suppliers for cost or unique ingredients), which will now cost much more. Hotels may need to find local or alternative foreign suppliers for these amenities or simplify their offerings to guests to control costs.

Furniture, Electronics & Decor Supply Crunch: Prior U.S. tariffs (around 10–25% in recent years) had already prompted some diversification of furniture manufacturing to Vietnam, Indonesia, and other countries. However, China remained integral to hospitality supply chains due to its immense production capacity and low costs. “Even with the [2018] tariffs, China still has better pricing than any other country… It’s hard to find places that are set up for that level of production,” explained one hotel furniture manufacturer about the continued dependence on Chinese factories. Now, with a 125% duty in place, Chinese-made furnishings lose their price advantage entirely, and hotels must pivot quickly. Procurement firms are exploring factories in Southeast Asia, but many of those facilities themselves source components from China or have limited output. In the short term, this means project delays and potential product shortages. A hotel expecting a shipment of Chinese-made guest room furniture or electronics may find those orders stuck or the vendor demanding a dramatically higher price to cover the tariff. Essential electronics are a particular concern – computers and electronic products are the single largest category of Chinese imports to the U.S. (about 30%), including things like the flat-screen TVs in guest rooms, Wi-Fi routers, security cameras, phone handsets, and lobby entertainment systems. Many hotels are mid-upgrade to newer smart TVs or IoT-based systems; those plans might be halted or see costs double if the equipment was coming from China. Even smaller devices like minibar refrigerators, coffee makers, or AC thermostats often originate in China. The supply chain disruption is forcing hotels to hunt for non-Chinese models (perhaps South Korean TVs, or Mexican-made mini-fridges), but alternative suppliers may raise prices too or struggle with capacity, given the sudden surge in demand from all corners of the U.S. economy seeking non-Chinese goods.

Longer Lead Times and Inventory Challenges: Another consequence of the tariff is logistical delay. Switching suppliers or countries is not instantaneous – production and shipping timelines are lengthening. Domestic manufacturers of hotel furnishings and equipment, while an option, often have far smaller capacity than China and could quickly become backlogged. Neil Flavin of HVS notes that if hotels rush to American manufacturers to avoid tariffs, “turnaround time will be slower” due to surging demand and limited production lines. Hoteliers used to just-in-time delivery for supplies might need to increase inventory stockpiles of key items (like linens or guest supplies) to hedge against delays. But stockpiling itself is expensive and ties up capital – a tough ask when cash flows are under pressure. Some larger hotel companies began contingency planning months ago when tariff threats emerged, pre-ordering goods before the tariffs hit. Others are adopting a strategy of maintaining two suppliers in different countries for critical items, an approach procurement advisors have long recommended to mitigate trade risk. For example, a hotel chain might have one furniture vendor in Vietnam and another in Mexico so that if one supply line becomes cost-prohibitive, the other can be a fallback. These multi-sourcing strategies, however, are easier for big brands and luxury hotels with resources; small independent hotels have less leverage to diversify and must often simply pay higher prices or do without.

In sum, the tariff has thrown hotel supply chains into turmoil. Every link – from factory to freight to warehouse – is adjusting to a new reality of either drastically higher costs on Chinese goods or the complexity of finding replacements. This disruption is testing the hospitality industry’s resilience and creativity in procurement. Hotels that can quickly adapt their supply chains (or had already diversified sourcing) will fare better than those deeply dependent on Chinese imports. But in the near term, delays, cost overruns, and even product quality variations (when substituting suppliers) are likely inevitable, potentially affecting the guest experience if, say, a hotel has to use a lower-grade linen or a different TV model than originally planned.

Pricing Pressures and Changes to Guest Experience

With operational costs rising so steeply, U.S. hotels face intense pricing pressure. Executives must decide how much of these new costs can be passed on to guests through higher room rates or surcharges, and how to adjust service models to preserve profitability. Both luxury and budget properties are walking a tightrope: raise prices too much and deter guests, or absorb costs and squeeze already thin margins. The tariff shock comes at a time when travel demand was recovering post-pandemic but could be dampened by broader economic effects (like inflation and retaliatory moves abroad).

Higher Room Rates and Surcharges: Many hotels will have little choice but to consider raising room prices to offset the tariff-driven cost increases. Items that guests rarely think about – the cost of the mattress they sleep on, the towels they use, the TV they watch – are all higher now for the hotel owner. According to industry consultants, passing on even a portion of these costs to consumers may be necessary for hotels to stay afloat. We may see hotels explicitly add new fees or surcharges; for example, some properties are rumored to be weighing a temporary “import cost fee” or similar line item on bills. Others might simply incorporate the increase into the nightly rate. However, this strategy carries risks: higher prices could deter price-sensitive travelers, especially in the economy and mid-scale segments. If a family’s favorite budget hotel raises its rate from $100 to $120 per night to cover costs, that family might shorten their vacation or choose a cheaper alternative like a roadside motel or Airbnb. Business travel budgets could be trimmed as well, with companies re-evaluating which hotels employees stay at. There’s evidence that consumers are already facing many inflationary pressures in 2025, and travel is a discretionary expense often cut first when budgets tighten. As one hospitality analyst noted, guests will reach a “tipping point where they cut back on travel because rates have gone up so much already, along with the costs of other goods and services”. In essence, if hotels uniformly hike prices to cope with tariffs, they risk creating a demand slowdown – fewer bookings as travelers balk at the cost.

Stagflation Concerns – Higher Prices, Lower Demand: Some financial experts are warning that the hotel industry could enter a “Trump slump” period of stagflation, characterized by rising prices and falling demand. Truist Securities has noted that if these tariffs act like a massive tax on consumers, we might see travel demand drop even as room rates rise, a challenging scenario for hoteliers. Discretionary leisure travel and dining are often the first to go when consumers feel a pinch. If broad inflation takes hold due to tariffs on not just Chinese goods but imports worldwide, U.S. consumers may cut back on vacations. This would hit mid-range and luxury hotels in tourist destinations especially hard, as those depend on healthy consumer confidence. Already, tourism analysts caution that international visitor numbers could fall in response to the heightened trade tensions – foreign travelers might be less inclined to visit the U.S. due to a strong dollar, higher costs, or political frictions. For instance, Chinese tourist arrivals (a key segment for many high-end hotels in cities like New York and Los Angeles) could decline if China imposes its own retaliatory measures or if public sentiment turns negative. Such external demand factors compound the pricing dilemma: hotels might be raising rates at the very moment fewer travelers are willing to pay.

Impact on Guest Experience and Services: To manage costs without simply raising prices, many hotels are looking inward for efficiencies. Service models may be tweaked to reduce expenses. One likely adjustment is in housekeeping and laundry services. During the pandemic, numerous hotels started offering housekeeping less frequently (e.g. only on request or every few days) as a cost-saving measure; now, faced with exorbitant linen replacement costs and higher labor expenses, hotels may continue or expand such policies. A mid-range or budget hotel might advertise “help us conserve water – towels changed every three days” which also conveniently saves on purchasing as fewer towels wear out quickly. Similarly, hotels could opt to use slightly lower-cost amenities: for example, switching from an imported boutique soap to a domestically made generic brand to save a few cents per guest. Breakfast buffets and food service might see changes too. Tariffs on food imports (like the Mexican avocados for the buffet or European coffees and teas) drive up F&B costs. In response, some hotels may cut back on complimentary breakfast offerings or start charging for items that used to be free. We could see more limited menus, more seasonal/local sourcing, or surcharges for certain high-cost items. While luxury hotels will strive to maintain a premium experience, they might quietly remove the most import-heavy luxuries – for instance, a luxury hotel that used to give every guest an imported Chinese silk robe may replace it with a domestically sourced luxury cotton robe, balancing guest comfort with cost control.

On the positive side, some hotels might roll out value-added packages or discounts to entice guests, effectively giving back some of what they added in price. Analysts suggest hotels will need to dangle perks or loyalty points to keep customers from defecting to other options. For example, an upscale hotel that raises rates might include a $50 resort credit or a free dinner to soften the blow. Economy hotels might offer a gasoline gift card or a slight discount for multi-night stays to appeal to budget-conscious travelers who are feeling the strain. These marketing tactics aim to preserve occupancy even as base prices climb.

Importantly, hotels will be cautious not to compromise core service quality too much. There’s only so far a property can cut corners (like thinner towels or fewer toiletries) before it hurts guest satisfaction and brand reputation. Many luxury hotels will likely absorb cost increases on critical guest-touch items to ensure the experience remains top-notch – their clientele expects it, and they can justify higher room rates more easily than a budget hotel can. Mid-scale hotels might selectively trim amenities (maybe fewer in-room freebies or scaled-back shuttle services), communicating changes as “environmentally friendly” or “streamlining” measures to reduce guest pushback. Budget hotels, having fewer frills to begin with, may have to simply endure slimmer profit margins if they cannot raise rates enough. In all cases, the guest experience is being carefully re-evaluated to find savings wherever possible without driving customers away.

Strategic Adjustments and Industry Response

Facing these multifaceted challenges, hotel companies are devising strategic responses to survive and adapt under the new tariff regime. The playbook includes supply chain maneuvers, financial strategies, and advocacy efforts. Industry leaders are aware that the sooner they adjust, the better they can mitigate the impact on their business.

Diversifying and Re-Shoring Supply Chains: A primary strategy is to reduce reliance on Chinese suppliers by diversifying the supply chain. Hotels and their procurement partners are expanding their network of vendors to include more producers from Southeast Asia, Latin America, and domestic U.S. sources. The trend of shifting production that began during the 2018–2019 trade war is accelerating: factories in Vietnam, Malaysia, Thailand and others have already seen increased orders as companies pivot away from China. However, truly replicating China’s manufacturing scale is a long-term challenge In the interim, we may see creative solutions like Chinese companies investing in operations in tariff-free countries to continue serving the U.S. market (this was observed in 2018, when some Chinese furniture makers set up satellite factories in Vietnam to work around tariffs. Hoteliers are pressing their suppliers for transparency and flexibility: for instance, a furniture supplier might shift production of a chair from a Chinese plant to its factory in Indonesia if possible. Larger hotel brands with significant purchasing power are in a better position to demand such changes. Meanwhile, domestic sourcing is being explored for select items – especially where quality and timing are critical. Some boutique hotels are turning to local craftsmen for furniture or decor, and big chains are asking U.S. manufacturers of mattresses or casegoods for bulk deals. This onshoring can shorten supply lines and avoid tariffs, though often at a higher baseline cost. Notably, even U.S. producers may raise prices now (“why shouldn’t we charge more… they’ll pay whether it’s from me or another country,” as Flavin put it, but at least domestic buying insulates against unpredictable trade policy changes.

Financial Planning and Cost Management: On the financial front, hotel owners are hedging against the tariff’s economic fallout. Those planning renovations are rushing to secure financing before interest rates potentially rise due to tariff-fueled inflation. Locking in loans now could save significant expense if borrowing costs jump later (a very real prospect if the Federal Reserve reacts to inflation). Many companies are also revising their budgets to build in higher cost contingencies. It’s now prudent to pad project budgets significantly – some consultants recommend adding 10–15% extra in FF&E budgets as a contingency for tariff-related cost spikes. Hotels are scrutinizing expenses across the board to find offsets for the import costs. This might include renegotiating vendor contracts, cutting discretionary spending, or improving energy efficiency (to reduce utility bills and free up funds). In some cases, hotels will defer non-urgent expenditures (like cosmetic upgrades or new software systems) to conserve cash for essentials. The larger hotel ownership groups and REITs are also reallocating capital strategically: projects in the development pipeline might be re-prioritized, with those less affected by tariffs (e.g. a hotel conversion that reuses an existing building domestically) moving ahead, while ground-up new builds heavy on imported materials get paused.

Adaptation of Brand Standards: A subtle but important strategic shift may occur in how hotel brands enforce their brand standards and renovation cycles. Under normal circumstances, big brands require properties (especially franchises) to refresh décor and amenities every few years to maintain consistency. Now, with costs doubling, brands are showing some flexibility. “Brands have become slightly more flexible since the pandemic… they are or can be negotiable to a certain point,” in terms of required renovations, notes Flavin. We can expect franchisors to extend deadlines for property improvement plans (PIPs) or allow alternative materials in order to ease the burden on owners. For example, a mid-range brand might temporarily allow a hotel to keep its current casegoods an extra year past the usual replacement date, or permit a cheaper flooring material as a substitute for the specified (imported) tile. This flexibility is a strategic necessity to prevent widespread owner distress or non-compliance. It also helps ensure that cutbacks don’t overtly degrade the guest experience – by adjusting standards, brands and owners collaboratively find acceptable solutions (perhaps a different design that can be sourced tariff-free) that meet brand aesthetics at lower cost.

Industry Coalition and Advocacy: At the industry level, hotel associations and coalitions are actively responding. Groups like the American Hotel & Lodging Association (AHLA) are likely lobbying the government for relief measures or exceptions. The hospitality sector is pointing out that tariffs on essential imports are indirectly a tax on U.S. businesses and consumers, and urging policymakers to consider swift negotiations. The National Restaurant Association has already voiced concern about food cost impacts, and similarly, hotel industry representatives are highlighting how tariffs threaten jobs (from construction workers to hotel staff if projects and occupancy decline). While the political winds may not favor an immediate reversal of the policy, there is pressure building to at least carve out critical sectors. For instance, there might be pushes for temporary tariff exemptions on certain hospitality-related goods (say, a quota of hotel furniture allowed in at a lower duty) to buffer the industry. In parallel, some hotel companies are investigating the use of Foreign Trade Zones or bonded warehouses – these are mechanisms where imports can sometimes be stored or used in certain ways without immediately incurring duties, though their applicability for hotel FF&E is limited.

Finally, some companies are taking an optimistic long view. A few well-capitalized hotel firms see opportunity in the chaos: those that can absorb the cost in the short term might continue renovation projects and be positioned with fresher products when competitors who delayed renovations are just starting theirs later (and possibly facing even higher costs or interest rates). Additionally, if the tariffs eventually lead to more U.S. manufacturing (as intended), hotels could benefit from more stable domestic supply chains years down the road. But in the near term, caution is the watchword. As one hotel supply executive put it, maintaining “transparency and flexibility” with all stakeholders – vendors, lenders, brand franchisors, and even guests – is crucial while navigating this uncertainty.

Varied Impact on Luxury, Mid-Range, and Budget Hotels

Not all hotels will feel the tariff pinch equally – the impact varies by hotel segment, since luxury, mid-range, and budget properties operate at different price points and cost structures. Each segment faces unique challenges and may employ different tactics in response:

Luxury Hotels:

High-end hotels (upscale chains and five-star resorts) generally have more financial cushion and pricing power, but they are not immune to tariff effects. Many luxury properties pride themselves on top-quality imported furnishings – Italian marble, Egyptian cotton linens, high-tech Japanese toilets, etc. While they might source certain luxury decor from Europe, a surprising number of back-of-house items (commercial electronics, security systems, even staff uniforms) might come from China. These hotels will absorb increased costs on critical guest-facing items to preserve their luxury standards, likely simply paying more for Chinese goods or swiftly finding premium alternatives in other countries. Room rates at luxury hotels are likely to rise to help offset costs, but their affluent clientele may be more tolerant of price hikes. For example, a $500/night room might become $550 without losing its niche customer base, especially if positioned as maintaining quality.

Luxury hoteliers might also leverage this moment to emphasize exclusivity and high-touch service – an attempt to justify higher rates. However, luxury hotels are exposed to other risks: if corporate travel budgets are cut or international tourism declines (e.g. fewer big-spending Chinese or European travelers visiting), they could see occupancy drops. In past economic slumps, the luxury segment often sees sharper occupancy declines as businesses and wealthy individuals tighten travel spending. Thus, luxury hotels must walk a fine line, using their reserves and brand reputation to sustain quality while carefully increasing prices. They might delay some non-essential capital projects but are unlikely to let the guest experience deteriorate noticeably. In terms of strategy, many luxury brands will double down on differentiated offerings (spa packages, exclusive experiences) to make sure guests feel they are getting value for the higher prices. Their larger profit margins and access to capital also mean luxury hotels can invest upfront in alternative sourcing – e.g. contracting a U.S. artisan to produce custom furniture – something a smaller hotel couldn’t afford. Overall, luxury hotels have more levers to pull (and deeper pockets), which gives them a slightly better chance to weather the tariff storm by passing costs to guests and maintaining their brand promise.

Mid-Range Hotels:

The mid-scale segment – think popular family and business hotels like Holiday Inn, Hilton Garden Inn, Courtyard by Marriott, etc. – faces a balanced mix of challenges. These hotels operate on moderate margins and cater to the broad middle-class traveler and corporate market. They typically furnish rooms with cost-efficient, durable goods (often made in Asia) and offer a decent array of amenities at a value price point. A 125% tariff on many of their go-to suppliers presents a big headache. Mid-range hotels will try to pass on some costs but are limited in how much they can increase rates before their value-conscious guests seek alternatives. We may see mid-range room rates creep up modestly (for example, a $150/night rate going to $165), but these hotels will also look hard for internal savings to avoid pricing themselves out of the market. Guests in this segment are somewhat price-sensitive but also expect a certain standard – they might accept a $10 higher rate, but not if the hotel has cut too many amenities. So mid-scale operators will aim to preserve core guest offerings while trimming expenses behind the scenes. They might reduce the variety of items at breakfast or use slightly lower-cost toiletries, but they’ll try to keep the overall guest experience consistent.

Unlike luxury hotels, mid-range ones cannot simply charge a premium for the same product; they must maintain a reputation for value. Many mid-range properties will leverage brand support – the large franchisors may negotiate bulk purchases of tariff-free goods for their franchisees, easing the burden via scale. For instance, a brand might source bathroom fixtures from Turkey or Vietnam in bulk and supply to hotels, replacing the Chinese source. Strategic deferral of renovations will be very common here: if a mid-scale hotel was due for a soft goods renovation (new carpets, drapes, bedding) in 2025, it might push it to 2026 or 2027 in hopes that tariffs abate or alternative supply chains stabilize. This segment will also be closely watching guest feedback; if they cut or change something due to cost (say, no more free cookies at check-in or a shuttle service cut), they’ll monitor if it impacts guest satisfaction scores. If demand does soften industry-wide, mid-range hotels might benefit somewhat from “trading down” – travelers who choose a Hampton Inn instead of a Waldorf Astoria to save money. But they could also lose some frugal guests to budget competitors if their prices climb. In summary, mid-range hotels are likely to take a hybrid approach: moderate price increases, selective cost-cutting, and heavy reliance on brand-driven solutions (like group purchasing and adjusted standards) to get through this period.

Budget & Economy Hotels:

Low-budget hotels and motels (e.g. Econo Lodge, Motel 6, Super 8, independent roadside inns) are in many ways the most vulnerable to cost shocks. These properties operate on very thin profit margins and attract highly price-sensitive guests. A budget hotel’s competitive edge is its low price, so any significant increase in operating costs that forces room rates up could directly hit occupancy. Many economy hotels source nearly all their supplies from the lowest-cost providers, which often meant Chinese imports – from inexpensive furniture and light bulbs to bulk linens and cleaning supplies. With those costs doubling under tariffs, budget hoteliers face an unpleasant choice: raise nightly rates (and risk driving away cost-conscious travelers), or absorb the costs and see profits evaporate. We will likely see a bit of both. Some economy hotels will attempt to absorb costs by aggressively cutting expenses elsewhere. Owners might reduce staff hours, eliminate free breakfast or coffee, or cut back on maintenance spending (hoping to postpone repairs) to save money. For example, an independent motel might stop offering little shampoo bottles or switch entirely to the cheapest possible U.S. supplier for soap and toilet paper. They will also try to conserve on energy and water (some motels might install motion sensors to cut electricity use, etc.). Despite all this, completely absorbing a 100%+ increase in key input costs is unrealistic – rate increases will happen even in the budget tier, perhaps in the order of an extra $5–$15 per night. Guests who normally might not flinch at $60 may start reconsidering at $75. As a result, budget hotels fear losing clientele either to even cheaper accommodations (campgrounds, hostels) or dropping out of traveling altogether.

In a worst-case scenario, some budget hotels could face temporary closures or bankruptcies if they can’t cover expenses, particularly in areas where demand is soft. On the other hand, if overall travel costs rise, some travelers who can no longer afford mid-scale hotels might downgrade to budget hotels, which could help occupancy. Budget operators will emphasize their value proposition – perhaps marketing that they still offer the “lowest price in town” even if that price is a bit higher than before. They’ll also lean on any franchisor support if available (economy chains will try to negotiate cost concessions from suppliers on behalf of their franchisees). In terms of strategy, expect budget hotels to be extremely frugal: stretching the lifespan of every asset (reusing old furniture longer, patching linens), and possibly adopting no-frills models (minimal housekeeping, no amenities) to keep rates as low as possible. This segment has the least flexibility to adapt, and for travelers, the experience may noticeably change (rooms might not be updated as often, services might be pared down). Essentially, economy hotels will fight to remain the affordable choice, but it will be a tough battle as their own costs climb steeply.

Conclusion

The 125% tariff on Chinese imports represents a seismic shift for the U.S. hotel industry. It is inflating costs for operations and development at a rate few executives could have imagined, and forcing hotels of every category to rethink how they do business. Hotel operations are under strain as renovation budgets swell and equipment purchases are put on hold. Global supply chains that once delivered low-cost goods seamlessly from Chinese factories are now disrupted, compelling hotels to seek new suppliers and face inevitable delays and quality concerns. These challenges flow through to the guest experience and pricing, with hotels delicately balancing cost recovery against the risk of alienating guests. From the glitzy luxury resorts to the no-frills roadside motels, each segment is charting its own survival strategy under these tariffs, whether that means raising a Ritz-Carlton’s room rate by $50 or cutting a Super 8’s free breakfast to save $0.50 per guest.

Industry stakeholders are actively responding – reprioritizing projects, pressuring supply partners, and banding together to advocate for relief. Expert commentary underscores that this is a time for nimble planning and level-headed management. “The best advice I would tell people is, there’s no reason to panic,” said one hospitality procurement chief during earlier tariff scares, emphasizing contingency planning and sourcing flexibility. That advice holds true now more than ever. Hotels that invest effort into creative solutions – from bulk-buying critical items ahead of time, to negotiating with brands for temporary standard adjustments, to marketing innovative packages – will be better positioned to withstand the storm.

In the coming months, guests may notice subtle changes: higher prices, yes, but also different amenities or fewer extravagances as hotels adjust. The overall hospitality experience in the U.S. could shift towards a slightly leaner model as the industry tries to maintain service with tighter margins. Yet, the spirit of hospitality is resilient. If there is a silver lining, it’s that the crisis is compelling hotels to become more efficient and resourceful, and to re-evaluate supply chains that perhaps were too concentrated in one country. In the long run, some of these adjustments – such as diversified suppliers or energy-saving operational tweaks – could benefit hotels even after the tariff situation resolves.

For now, hotel executives and staff will be watching the situation closely, hopeful that trade tensions ease but prepared to adapt if they do not. The hospitality industry has weathered economic storms before, and while a 125% tariff is a formidable challenge, the combination of prudent financial management, strategic adaptation, and a focus on guest value can help hotels ride it out. As one asset manager quipped, this turbulent period might just be “the ultimate stress-test” for hotel business models – and those that emerge successfully will be that much stronger for it. The next year will reveal just how innovative and resilient America’s hotels can be in the face of unprecedented cost pressures.