Top 5 Hotel Scams Targeting Staff and How to Prevent Them

Table of Contents

ToggleRunning a hotel involves juggling many responsibilities, and ensuring the safety of your property and guests is paramount. However, scammers frequently target hotels, exploiting vulnerabilities in staff training and procedures. In this article, we’ll explore the top 5 hotel scams that target staff and provide practical advice on how to recognize and prevent them. From counterfeit money to chargeback fraud, we’ve got the insights you need to keep your hotel secure.

1. Money Scam

Counterfeit Money:

One of the oldest tricks in the book is using counterfeit money. Scammers often pass fake bills to unsuspecting hotel staff, especially during busy check-in times when employees might be less vigilant. They typically hand over large denominations, hoping that the rush of the moment prevents thorough checks.

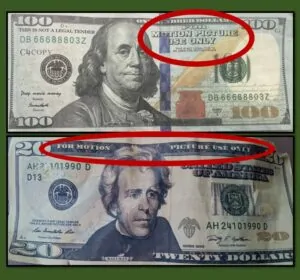

Motion Picture Money:

A variant of counterfeit money, motion picture money, is designed to look like real currency but is marked with phrases like “For Motion Picture Use Only.” It’s often used in films and videos but can easily fool untrained eyes.

How to Tell the Difference:

- Feel the Paper: Genuine money has a distinct texture. Fake bills, including motion picture money, often feel smoother.

- Watermark: Hold the bill up to the light. You should see a watermark that is part of the paper itself, not printed on.

- Security Thread: A thin embedded strip runs from top to bottom. On U.S. bills, this strip glows under ultraviolet light and shifts color in light.

Tools to Verify Authenticity:

- Pens: Special counterfeit detection pens can help determine if a bill is real. When marked, real bills should show a light yellow color. If the mark turns dark, it’s likely counterfeit.

- Machines: Automated currency detectors provide a more foolproof method, scanning for multiple security features like infrared marks, magnetic ink, and size consistency.

Preventative Measures:

To avoid falling victim to counterfeit money scams, consider shifting to a credit card-only policy or ensuring a credit card is kept on file with an authorization.

Credit Card Only Policy:

- Eliminate Cash Transactions: By only accepting credit cards, you remove the risk of handling counterfeit money entirely. This also simplifies accounting and reduces the need for cash handling protocols.

- Staff Training: Train your staff on how to properly handle credit card transactions, including checking IDs and verifying cardholder information.

Credit Card Authorization on File:

- Pre-Authorization: Require a credit card for pre-authorization at check-in. This ensures that the card is valid and reduces the risk of fraudulent transactions.

- Authorization Forms: Use authorization forms that require both ID and credit card information. This adds a layer of security and helps verify the authenticity of the cardholder.

Training Tips:

- Regular Drills: Conduct regular training sessions to keep staff sharp on recognizing counterfeit money and handling credit card transactions.

- Provide Resources: Keep up-to-date reference materials on genuine currency available at the front desk and ensure staff are familiar with the hotel’s credit card policies.

2. Phone Call Refund Scam

In light of recent scams targeting hotel employees, particularly during vulnerable night shifts, it’s crucial to be aware and vigilant. Scammers have been known to impersonate corporate IT staff, hotel owners, and other official positions to gain access to hotel systems. Here’s how employees can protect themselves and their establishments from falling victim to these deceptive tactics.

Understand the Scam:

Scammers typically call during the night, claiming to be from the hotel’s corporate office or IT department. They might mention a system update or the need to test equipment, like PIN pad systems, and ask employees to perform tasks that involve entering or moving money. They are often well-prepared, using correct terminology and may even drop names of known staff or recent events to appear legitimate.

Preventive Measures:

Verify Caller Identity:

- If you question the legitimacy of a call, request the caller’s name and title. Instead of continuing the conversation or calling back on a number they provide, use your hotel’s official support line to confirm their identity by asking for them directly.

- Do not proceed with any requests until you’ve confirmed the caller’s identity through known and secure channels.

Know Your Systems and Policies:

- Be familiar with how your hotel’s systems work, including how remote sessions are started. For example, logging into a secure portal specific to your franchise.

- Understand that legitimate support will never ask you to process refunds or log into systems to enter sensitive information without proper verification.

Consult with Management:

- If in doubt, always refer the situation to a manager, especially during times when scams are more likely, such as the night shift.

- Implement a protocol where any unusual after-hours calls are to be deferred to higher management.

Educational Training:

- Regular training sessions should be held to educate all employees about the latest scams and reinforce the importance of security protocols.

- Share stories and scenarios of known scams to prepare employees for potential situations.

Communication is Key:

- Encourage open communication among staff about suspicious activities. If someone encounters a potential scam, they should feel comfortable alerting others.

- Keep all employees updated about any incidents, whether they were avoided or not, to ensure everyone learns from them.

3. Prepaid Booking Scam

A guest claims to have a prepaid reservation but insists there’s been an error. They usually create a scene late at night when fewer staff are available, exploiting the reduced workforce and hoping to pressure employees into compliance.

Scenario:

- Guest’s Claim: “I paid for my room online, but there’s no record of my booking.”

- Tactics: They cause a commotion, pressuring new or tired employees to give them a room without proper verification.

How to Handle:

- Verify Booking: Always check the reservation system thoroughly. If there’s no record, there’s no obligation to provide a room.

- Request Proof: Ask for confirmation emails or receipts. Scammers often can’t provide verifiable proof.

- Stay Calm: Train staff to remain calm and follow protocol, even when under pressure.

Training Tips:

- Night Shift Training: Provide specific training for night shift employees on handling such scams.

- Escalation Procedures: Establish clear procedures for escalating suspicious situations to a supervisor or manager.

4. Using Locked Credit Cards / Stolen Cards / Gift Cards

Some guests attempt to use locked or stolen credit cards, knowing these might not be immediately flagged. They often check out quickly to avoid detection, leaving the hotel with unpaid bills.

Verification Steps:

- Match IDs: Ensure the guest’s ID matches the name on the credit card. Be particularly vigilant if the guest seems in a rush or hesitant to provide ID.

- CC Authorization Forms: Use forms that require both ID and credit card information. This additional layer helps verify the authenticity of the cardholder.

- Monitor Alerts: Stay updated on any alerts from your payment processor about recent stolen card trends.

Credit Card Activation:

Nowadays, credit cards can be activated to allow payments to process, which scammers exploit. Those who charge at checkout tend to have the most issues since the scammer can leave before the charge is flagged.

Training Tips:

- Daily Briefings: Include updates on recent fraud trends in daily staff briefings.

- Security Tools: Equip the front desk with tools like UV lights to check IDs and cards for tampering.

5. Chargeback Scam

Guests book rooms using legitimate-looking credit cards and later dispute the charges, claiming their cards were stolen. This results in chargebacks, causing significant financial loss to the hotel.

Common Scenario:

- Chargeback Claim: “I never stayed at this hotel. My card was used without my knowledge.”

- Hotels’ Loss: Hotels can lose thousands in revenue from these disputes, particularly if they can’t provide proof of the transaction.

Prevention Tips:

- Swipe Cards on Arrival: Always swipe the card at check-in, ensuring chip and PIN use when possible. This provides physical evidence that the card was present.

- Document Everything: Keep thorough records of the guest’s stay, including signatures, check-in/out times, and any additional charges.

Reports and Trends:

Reports indicate that both small properties and large resorts can lose thousands monthly due to chargeback scams. Often, if the reservation guest information does not match the credit cardholder’s name, the guest will dispute the charge, claiming they were not at the hotel.

Training Tips:

- Record-Keeping: Emphasize the importance of detailed record-keeping to all staff.

- Dispute Procedures: Train staff on how to handle disputes and gather evidence efficiently.

Being aware of these common scams is the first step in protecting your hotel. Train your staff to recognize suspicious behavior and implement strict verification procedures. By staying vigilant and informed, you can safeguard your property and guests from these deceitful tactics.